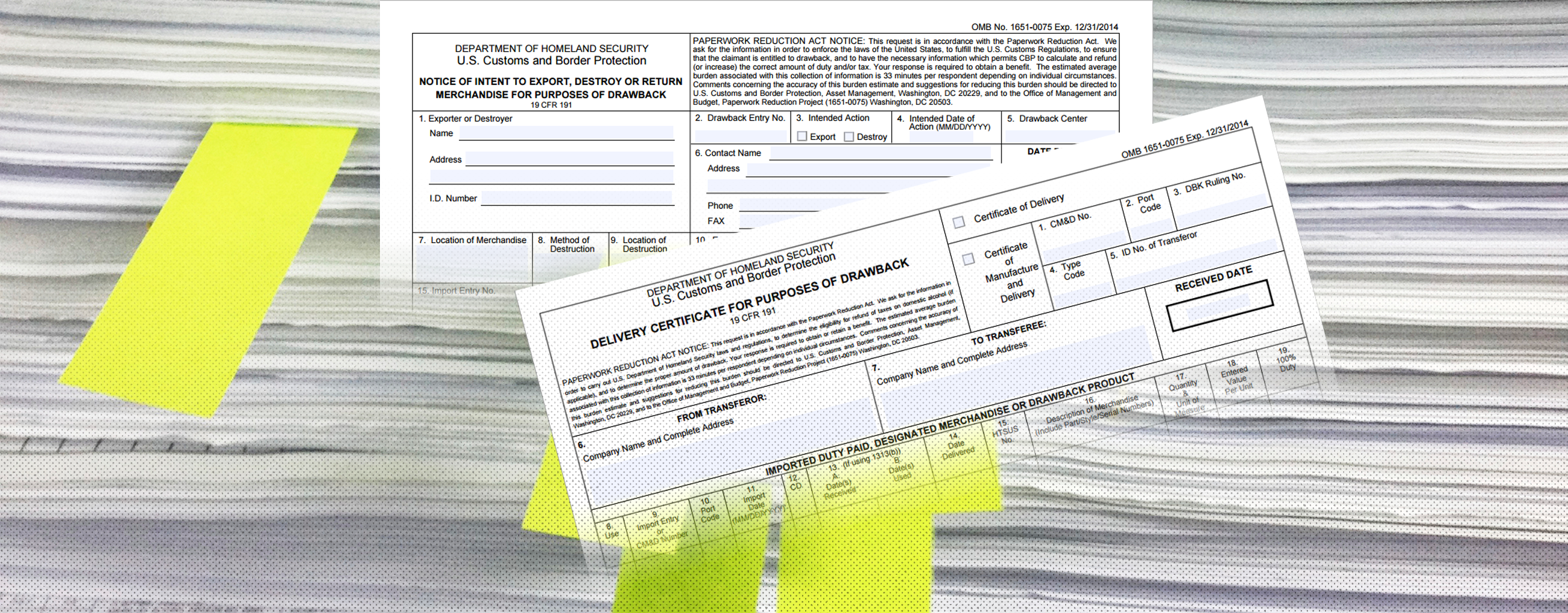

Hundreds of millions of dollars are left on the table annually by importers who do not take advantage of duty drawback opportunities. Duty drawback is the program whereby Customs will return 99% of the duty paid at the time of importation when goods are exported in a qualifying fashion. The time for recovery is limited, so importers who have been importing and then exporting either manufactured or same-condition merchandise should speak with us about potential recoveries. We take the information from the import Customs entries, match them to exports, file the necessary paperwork with Customs and work as quickly as possible to protect your right to recover as much money as you are entitled to by law.

Duty Drawback

Contact Merit Trade Consulting Services LLC

40864 N Tumbleweed Trail, San Tan Valley, AZ 85140 (847) 899-4131 merit@merittradeservices.com